A lot of people are scared to invest because the market is so complicated, it costs a lot to get in, and it takes a lot of time to handle portfolios.

This is where sites like Acorns that let you make small investments come in handy.

Acorns has become very popular among new investors and people who want to make the most of their extra change because it makes investing easier.

Should you spend your time and money on it? As someone who has used Acorns for more than a year, I can give you an in depth review based on both my own experience and professional research.

We’ll talk about everything you need to know about Acorns in this article, such as its features, price, pros and cons, and how well it fits the needs of different types of investors.

If you want to learn how to trade or are just looking for a simple way to make your savings grow, this article has everything you need to know.

What is the Acorns app?

This is an app called Acorns that makes micro investing easier by rounding up your purchases to the nearest dollar and investing the extra change.

It began in 2014 and has grown to give many financial tools, such as checking accounts, retirement accounts, and learning materials.

Because you can set it and forget it, the app is great for people who are just starting out.

Acorns takes care of everything, from adjusting and allocating your portfolio based on your financial goals and risk tolerance, so you don’t have to.[1]

Key Features of Acorns App

1. Roundups

The Roundups are what make Acorns stand out. As soon as you pay for something, the app rounds the amount to the nearest dollar and spends the extra money. If you buy coffee for $4.50, Acorns will round it up to $5 and put the extra $0.50.

2. Portfolios that can be changed

Acorns has five pre-made portfolios that you can choose from, ranging from safe to aggressive, based on your risk tolerance and financial goals.

Exchange Traded Funds (ETFs) that hold stocks, bonds, and other types of assets are used to diversify these investments.

3. Investments that keep coming back

You can set up automatic donations that start as little as $5 a day, week, or month. This function makes sure that your investment account grows steadily.

4. Found money

Acorns works with more than 350 brands to give you cashback, which is put straight into your account. You can make money while you shop.

5. Tools for Financial Wellness

Through its Grow platform, Acorns also offers educational material that helps users learn more about money.

A Full Review of the Wealthfront App for 2024

My Experience with Acorns App

A little over a year ago, I started using Acorns because I was interested in how simple it was. To test the Round Ups tool at first, I linked my main checking account.

I was surprised at how quickly those small purchases added up.

In just six months, I had put more than $400 into the account without even realizing that it changed how much I spent every day.

I also liked how Acorns changed my strategy based on how the market was doing.

This function made a huge difference for people like me who don’t have time to keep an eye on their investments all the time.

But I thought the monthly fees were a bit high for the small amount I was spending at first.

Pricing Plans of Acorns App

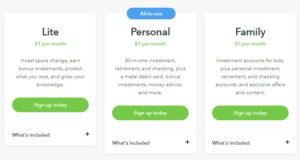

There are three price levels for Acorns:

- Personal ($3 a month): This plan comes with a bank account, an investment account, and an individual retirement account (IRA).

- The Family plan ($5 a month): This plan has all the same benefits as the Personal plan plus investment accounts for kids.

The fees aren’t too bad, but they can cut into returns for people who only spend a small amount. For example, if you only put $10 into an account every month, the $3 fee is 30% of your money.

Pros and Cons of Acorns App

Video Credit: Brendan Evan

Pros:

- User Friendly Interface: Acorns is simple and straightforward to use, which makes it ideal for new users.

- Autonomy: The app does everything, from saving to rebalancing.

- Low Barrier to Entry: You can start spending with as little as $5, so it’s easy to get started.

- Diversification: Portfolios have a good mix of different types of assets.

- Cashback Chances: The Found Money feature helps you save even more.

Cons:

- High Fees for Small Balances: The flat monthly fee can be a big part of small funds.

- Limited Customization: Advanced investors may not like that they can’t change the way their portfolios look.

- There is no tax loss harvesting: Acorns does not offer tax optimization strategies like some of its rivals do.

Robinhood App: A Full Review of the Well Known Trading Platform

Who Should Use Acorns?

- Beginners: Acorns is a great place to start if you’re new to saving and want to take a hands off approach.

- Busy professionals: who don’t have time or interest in managing their finances because the app does it all for them.

- Savers: This app is great for people who want to turn spare change into a business portfolio.

Who Should Stay Away from Acorns?

- Experienced investors: who want more control over their stock, Acorns might not be the best choice for you.

- Investors on a tight budget: If you can only afford to put a small amount of money each month, the fees might be more than the rewards.

Comparison with Other Apps

It’s worth comparing Acorns to other sites like Robinhood, Stash, and Betterment, even though it’s great for small investments:

- Robinhood: lets you trade stocks without any fees, but it doesn’t automate the process.

- Stash: is like Acorns, but you can pick your own stocks and ETFs.

- Betterment: This option focuses on automated investing and has features like tax loss harvesting, but it needs a higher minimum amount.

Tips to Maximize Your Acorns Experience

- Turn on Round Ups Multiplier: To make your stock grow faster, you can multiply your roundups by 2, 3, or 10 times.

- Set Up Recurring Investments: Over time, even small recurring payments can add up to a lot of money.

- Take Advantage of Found Money: shop at Acorns’ linked brands to get extra cashback.

Is Acorns App Safe?

Acorns is safe, yes. You can be sure that your data is safe with this app because it has 256bit encryption and is a member of SIPC, which covers investments up to $500,000. The market could go down, though, just like any other purchase.[2]

Case Study:

I’ve searched on different forums and got this user review. Reddit User (jhnnybgood) said Acorns is designed to be quick, easy, and extremely low input. Its great at what it does. For more knowledge visit Reddit

Final Words

Acorns is a great tool for people who are new to investing or just want an easy way to get started.

It is a strong competitor in the micro investing area because it is automated, has a low barrier to entry, and has educational resources. Small scale buyers may not like the monthly fees, though.

If you want to learn good money habits and increase your savings, Acorns has been a great tool for me.

Acorns is a good option if you’re serious about building wealth over the long run and can handle the fees. Other sites might have better features for more experienced investors or those with bigger portfolios.

If you think about your investment style and financial goals, Acorns can either be your first tool for investing or a way to get to more advanced ones. No matter what you decide, know that the best way to make money in the long run is to start early.

FAQs

Can Acorns make you lose money?

Yes, Acorns has market risks like any other investment, and the value of your account can change.

How does Acorns make money?

Acorns makes money from membership fees and paid partnerships with brands for the Found Money program.

Is Acorns a good way to save for retirement?

Acorns does offer IRAs as part of its Personal and Family plans. These are a great way to save for retirement.

Source:

Straut, N. (2024, October 1). What is Acorns: the investment app designed to make investing easy. Forbes.

James, M. (2024, September 25). Is Acorns a safe way to begin your investment journey? All About Cookies.